America’s Best Financial Tool for Savings & Retirement

Let us connect you with a licensed agent who can help you analyze and compare different options across multiple A+ rated insurers.

Cash Accumulation

Grow and protect your funds with tax-deferred benefits.

Living Benefits

Protects you and your family in case you become ill.

Death Benefits

Protects your loved ones in case you die too soon.

The Unmatched Power of Accumulation and Compounding Interest.

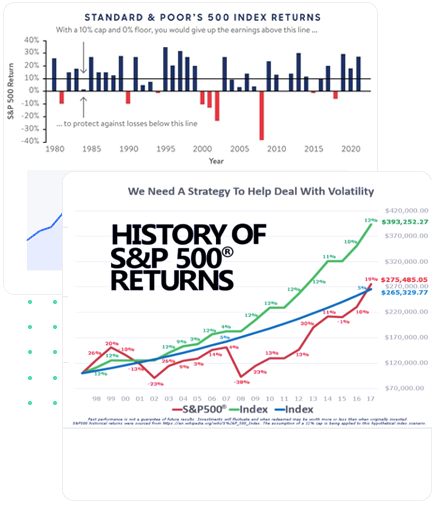

With IUL cash value life insurance, you can mitigate financial risk, earn high interest with market upside gains without losing money to the downside, reduce tax exposure, protect your funds from liens and garnishment, and optimize retirement income distribution.

0%

Minimum Rate

The Floor

8%

Maximum Rate

The Roof

Living Benefits pays when you need it; Not just when you die!

With IUL insurance policies, you may access your death benefit early under specific circumstances. For terminal illnesses, you can advance 80-100% of your policy’s death benefit if your life expectancy is 12 months or less. In the case of critical illnesses like ALS, cancer, kidney failure, heart attack, or major organ failure, you can advance up to 95% of your benefit. For chronic illnesses, if you’re unable to perform two out of six daily activities or suffer cognitive impairment, you can advance 24% of your benefit each year, up to 95% in total.

upto 95%

Advance on your death benefits for critical illness

upto 24%

Advance on your death benefits each year for chronic illness

Saving for retirement doesn’t have to be a scary process!

Want to potentially have 4x more tax-deferred cash for your retirement? An IUL (Indexed Universal Life) insurance policy might be the tool you’re looking for.

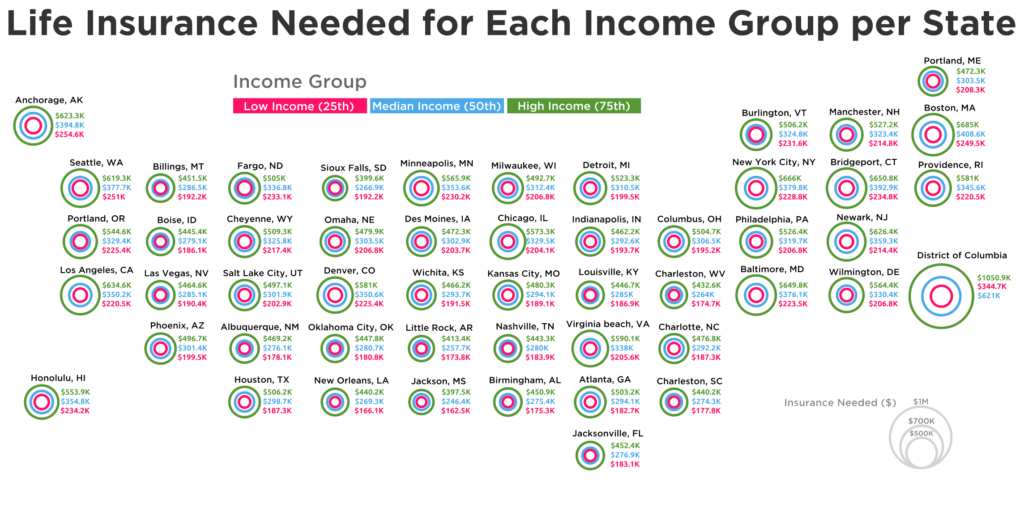

How Much Life Insurance do You Need? It Depends on These Factors

Everyone needs life insurance, but the amount varies for each person. To find the right coverage, consider your income and local cost of living.

Indexed Universal Life Insurance with Flexible Indexed Savings Fund

Indexed Universal Life (IUL) insurance offers lifelong coverage with no expiration. In case of death or illness, benefits are paid, but if nothing happens, the premiums plus interest accumulate in a flexible savings fund. This tax-deferred fund grows up to 8% annually through compound interest and can serve as a retirement account. Unlike other retirement accounts, IUL policies have no income limits, offering protection and potential market-based growth with safeguards against stock market losses.

Family Banking Loan Option Without Installments

IUL policies offer a unique financing option that lets you withdraw accumulated value without affecting returns or interest. This provides access to funds for expenses or investments while preserving long-term benefits. Loans are treated against the policy’s value, but interest continues to accrue on the full amount. Unlike mortgages, these “family banking” loans require no monthly payments and are repaid when the policy ends, using benefits or accumulated earnings, offering flexible financial management without monthly commitments. In some cases interest are deducted annually from accrued earnings.

Not ready to start but have questions? Chat with an agent today.

Everything you need to know about IULs policies.

Get a free consultation today!