IUL sales have fifth quarter of double-digit growth as individual life premium rises 4% in 3Q

WINDSOR, Conn. Dec. 12, 2023 – A strong economy and falling inflation sparked demand for life insurance in mid-2023, and that showed up in LIMRA’s third-quarter individual life premium surveys and estimates.

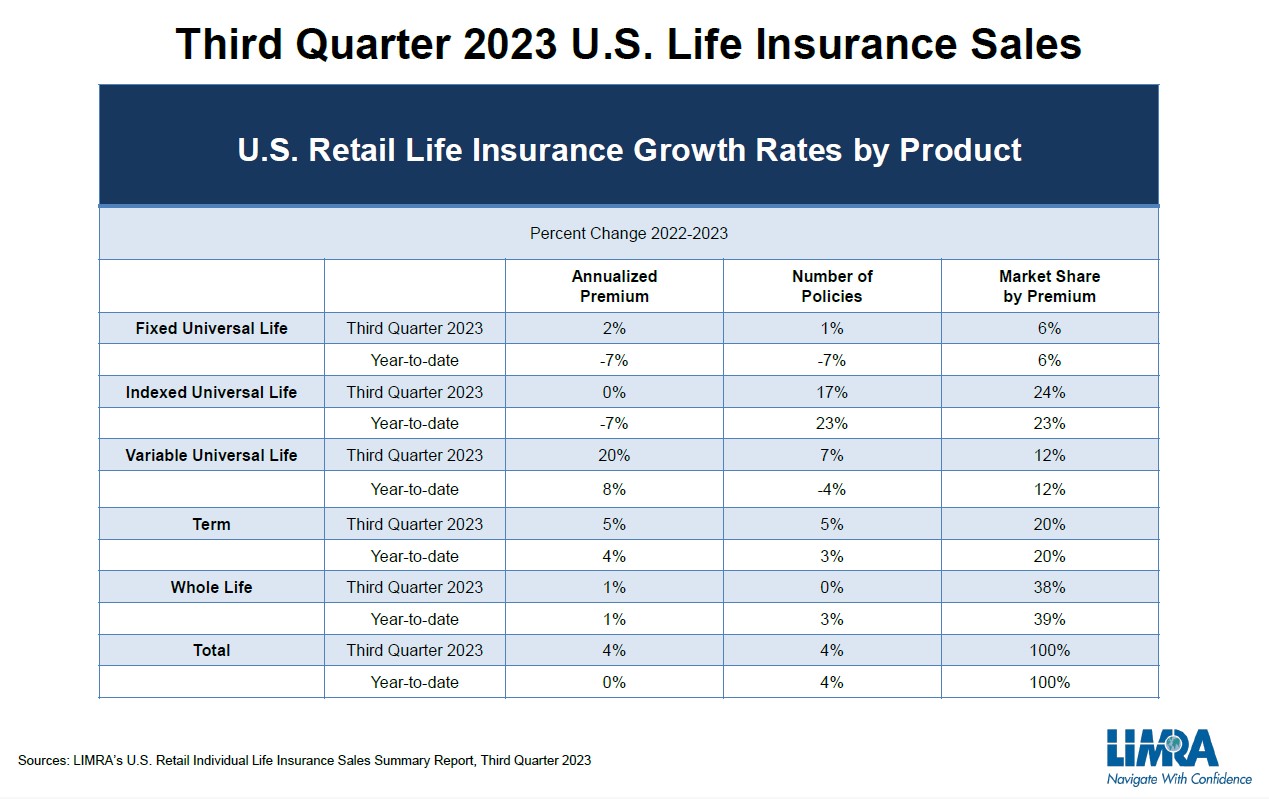

Total individual life insurance new annualized premium increased 4% to $3.7 billion year-over-year, according to LIMRA’s U.S. Retail Individual Life Insurance Sales surveys and estimates. Total new premium year to date was $11.5 billion, level with the same period in 2022.

The total number of policies sold in the third quarter increased 4% over the results in third quarter 2022, with 6 in 10 carriers reporting gains. For the first nine months of the year, policy count improved 4% year-over-year.

“Given the strong economy and falling inflation, demand for life insurance increased midyear,” noted Karen Terry, assistant vice president and head of LIMRA Insurance Product Research. “LIMRA is projecting overall life insurance sales in 2023 to match or slightly exceed the record-high premium in 2022.”

“Given the current economic conditions and regulatory landscape, the third quarter results are generally in line with what we expected. The individual product trends we are seeing are on track to meet the higher end of our sales forecast of overall growth in 2024 and 2025,” Terry added.

Indexed universal life insurance

Third quarter 2023 IUL premium was $871 million, level with results from prior year. Policy count jumped 17% year-over-year. YTD, new premium fell 7% to $2.6 billion, compared with the nine months of 2022. Through September 2023, the number of policies sold increased 23%, compared with prior year. YTD, IUL premium represented 23% of total U.S. premium sold.

“For the second consecutive quarter, a majority of IUL carriers reported growth this quarter” said Terry. “While regulatory changes and rising interest rates have presented challenges for IUL in recent years we expect a pause in IUL regulation and a slight downwards trend in interest rates to provide some relief next year.”

Whole life insurance

Whole life new premium totaled $1.4 billion in the third quarter, 1% higher than prior year. A majority of the top whole life carriers reported gains in the quarter. The number of whole life policies sold remained level with prior year. For the first nine months of 2023, new premium was $4.5 billion, up 1% from prior year and policy count increased 3%. Whole life market share measured by premium was 38% in the third quarter.

Term life insurance

Term life saw its third consecutive quarter of growth in premium and policy sales. Term insurance premium increased 5% in the third quarter to $731 million. YTD, term premium topped 2.2 billion, 4% higher than prior year. Policy count also grew, up 5% for the quarter and 3% YTD.

With strong results expected in the fourth quarter, LIMRA is forecasting term premium to grow as much as 6% in 2023. Term premium held 20% of the total U.S. life insurance market share in the third quarter.

Variable universal life

VUL premium jumped 20% in the third quarter to $464 million, driven by a small group of carriers. In the first three quarters, VUL premium totaled $1.4 billion, an 8% rise from prior year results. Policy sales also grew in the third quarter. The number of policies sold increased 7% year over year. YTD however VUL policy count is down 4%, VUL premium maintained 12% of the total U.S. life insurance market in the third quarter.

Fixed universal life

Fixed UL saw its first quarter or premium growth in six quarters. Improved interest rates helped fixed UL new premium to increase 2% in the third quarter to $223 million. YTD, new premium fell 7% to $709 million. Policy count ticked up 1% in the third quarter but remained 7% below the results from prior year. Fixed UL premium held 6% market share in the third quarter.

For more details on the sales results, go to Third Quarter 2023 U.S. Life Insurance Industry Estimates in LIMRA’s Fact Tank.

LIMRA’s Retail Individual Life Insurance Sales Survey represents 85% of the U.S. life insurance market. Since 1921, the U.S. life insurance industry has relied on LIMRA’s benchmark sales study for accurate data and trending insights.