Church & Ministries Tax-Optimization + Protection

An IUL is a financial instrument and a life insurance policy all in one. If you serve or lead a ministry, your biggest expense is taxation. Discover how you can protect your congregation, optimize your taxes, and safeguard them from every eventuality with cash value life insurance.

Family, Faith and Indexed Universal Life Insurance

Faith, protection, and finances go hand-in-hand. Indexed Universal Life (IUL) has the potential to change lives, impact ministries, and secure the financial future of congregations.

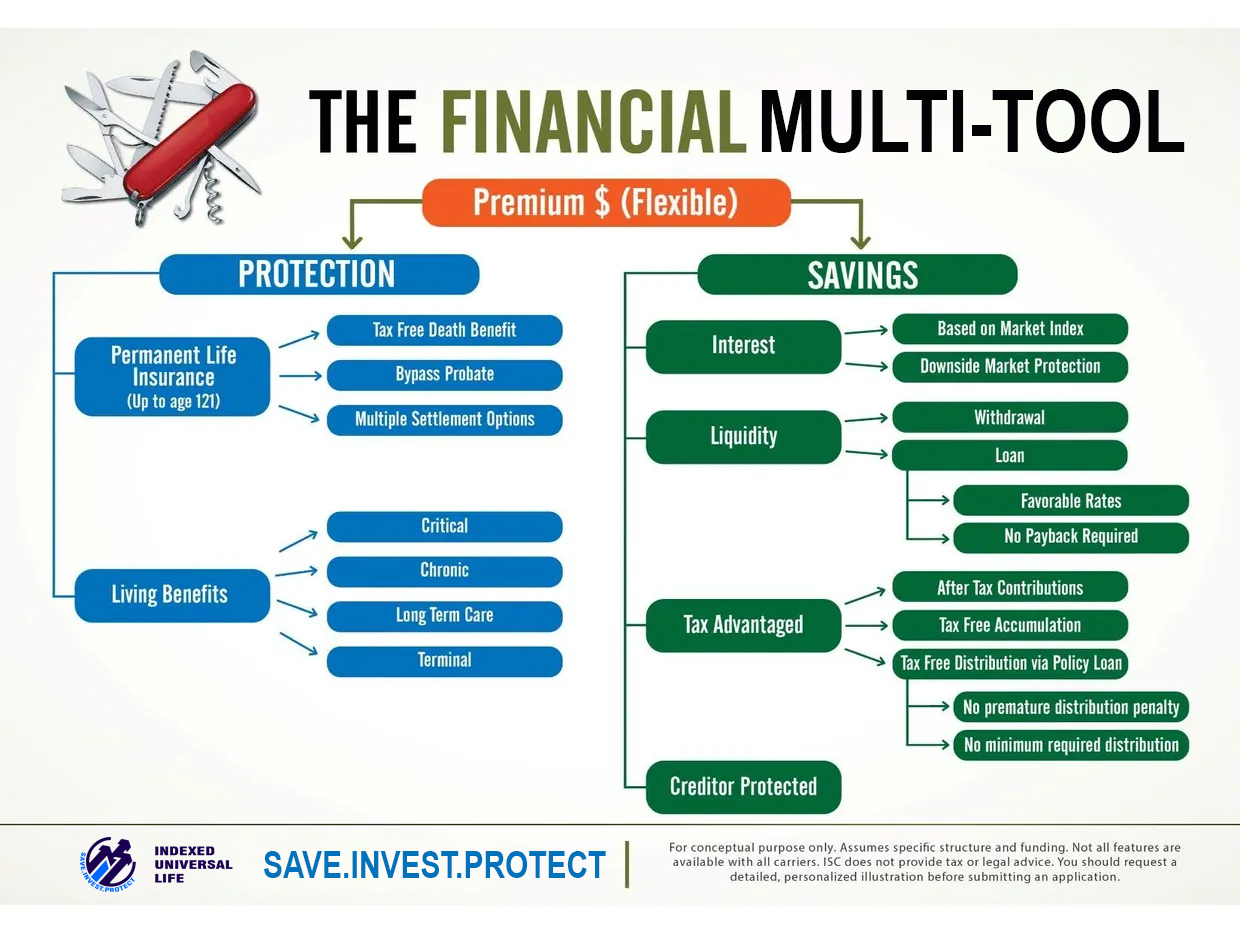

An IUL is mainly a life insurance product that offers living benefits , meaning it protects a person in case they dont die but get critically, terminally or cronically ill. It also shiled funds against liens and legal judgemnet and garnishment orders.

It can be applied for by a Key person in a ministry or any service member and employees intrested in extending this protection to thier families.

IULs are also a tax-proviledged financial tool for accumulating savings for retirement but also for any means. Infact IULs are offered in flexible plans that enables policy owners to vary the ammount of contribution and wodrwals witout penalties.

In general people chart of account would show tatt the biggest expesnes in in ministries is taxation. An IUL thanks to a recently passed legislataion named Employee Retirement Income Security Act (ERISA) benefits from special treatment in the taxation end enables for IUL on contrary to other retirement vehicles like 401K and IRAs not to have a maximum contribution per year. So the policy size can ammount to any ammounts without limitation and maximize earning form paid intrests. IUL link their cash value growth to market-based indexes, such as the S&P 500 or NASDAQ 100, in addition to a fixed account.

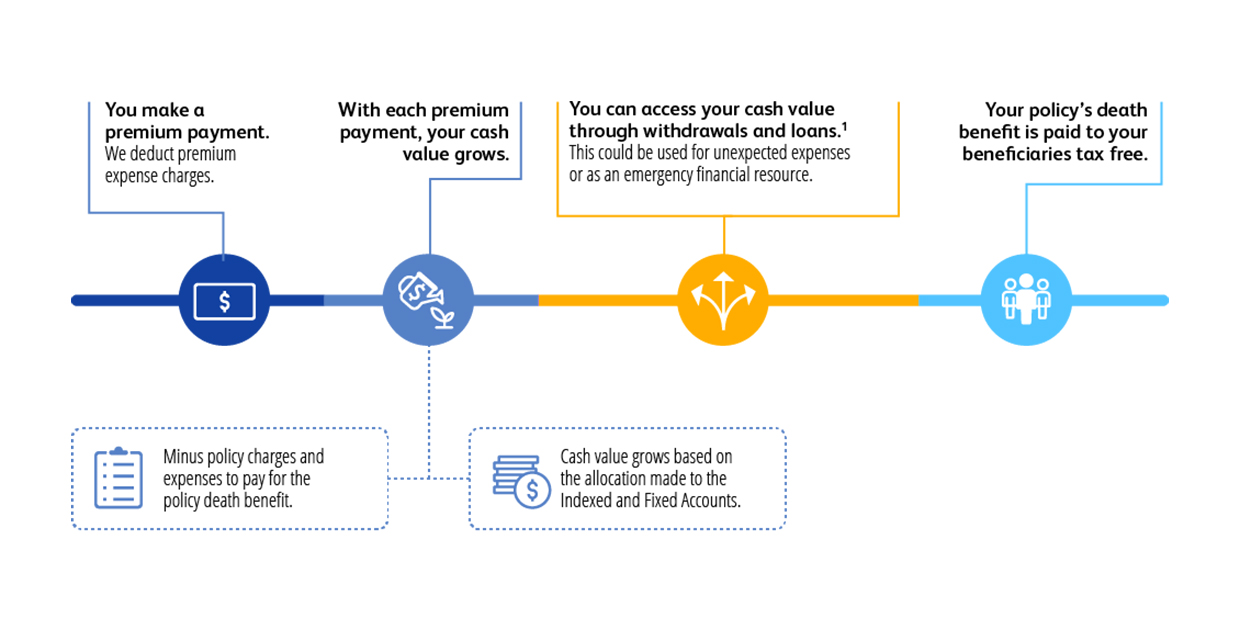

Indexed Universal Life Insurance gives policyholders the opportunity to benefit from market-linked growth without the risk of losing value due to market downturns, unlike variable life insurance policies. With IUL, cash value is built through premium payments and the growth tied to the performance of selected indexes.

Estimating Cash Value and Premium Costs

IUL calculators are often used to quickly estimate cash value accumulation and monthly premium costs, helping prospective buyers better understand how IUL policies work. This article explores the use of these calculators to evaluate Indexed Universal Life Insurance and illustrates the potential growth and benefits of an IUL policy.

The Bottom Line

Finding the best IUL policy can be complex due to the many moving parts involved. Consulting an IUL expert is highly recommended to ensure you get a policy that suits your needs. By carefully evaluating insurance companies and their offerings, you’ll be better equipped to select the most suitable IUL policy for your or your ministry financial goals.

IUL Calculator

Change age and monthly contribution to simulate different results.

A calculator that shows how much cash value you could build up including life insurance benefits.

Your policy’s cash value grow each year between a cap of 8% and a floor of 0%, averaging 6.44%. This means you never lose money and lock in gains annually with protection against market downturns. Use the sliding controls to adjust age and monthly contributions to see your potential cash value at retirement. For a personalized policy, see for how much you qualify and how much you can save.

(If you need cash)

(If you die too soon)

(If you become ill)

*Tables and charts are for illustrative purposes only and do not represent any specific policy example. Please consult with a licensed agent for a specific policy for additional information. All guarantees and contractual obligations are solely based on the claims-paying ability of the issuing company. The death, living benefits benefit will depend on the individual’s age and health the current calculator calculates values based on national averages for non-smoking clients.

IUL Insurance for Churches: Protecting Your Mission

Indexed Universal Life (IUL) insurance can be an effective solution for churches to safeguard their financial future while serving as a flexible resource for the needs of the community. Think of IUL not just as an insurance policy, but as a strategic tool for managing long-term growth, funding expansion projects, and ensuring stability for future generations.

With IUL, churches can accumulate cash value over time that grows based on index performance, offering both protection and potential for growth. This cash value can be accessed through policy loans, providing financial support for unexpected expenses, renovations, or even ministry expansion — without interrupting the investment’s growth potential.

What does an IUL cover for churches?

An IUL policy doesn’t just offer a death benefit; it’s designed to address the unique needs of your house of worship. In addition to providing a financial safety net, it can support the church in times of need — whether it’s covering operational costs, making emergency repairs, or ensuring that your ministry thrives despite financial uncertainties. With tailored coverage and strategic use, an IUL policy can become a cornerstone of your church’s financial planning.

Congress Created a Strategy for Churches to Build Tax-Free Wealth with Life Insurance

When Congress enacted the TAMRA regulations, it enhanced the potential of Indexed Universal Life (IUL) insurance for organizations like churches. This provision enables churches to build tax-free wealth that can support their mission and sustain future growth. With an IUL, churches can secure substantial coverage, earn competitive returns, and avoid market losses. Plus, the policy’s cash value and growth remain tax-free, providing financial flexibility to fund ministry projects or cover unexpected expenses—without compromising the church’s financial stability.

See If You Qualify—it takes just 5 minutes to see your potential wealth. Click Here

Protection From Down Markets

These policies can benefit from market gains through index performance, like the S&P 500, up to a cap, while being protected from market losses due to a typical 0% floor.

Generational Wealth Building

Upon your passing, the accumulated funds in your policy can be transferred to your beneficiary also tax-free.

Access To Money

You can usually access funds from an active policy tax-free during your lifetime.

Surprising Growth Potential

You have the potential to build significant cash value.

“

Get a Tailored IUL Strategy for Your Church — Free, No-Obligation Quote

Explore how an Indexed Universal Life (IUL) policy can benefit your church. Simply enter your information, calculate potential contributions in just 5 minutes, and speak to an expert. It costs nothing to see how an IUL can help build long-term financial stability. Get a no-obligation estimate in minutes and discover how this tool can secure your church’s future.

Indexed IUL Loans for Churches

Indexed IUL loans can be a powerful tool for churches looking to leverage their cash value for funding projects or managing cash flow. With an indexed loan your ministry gain access to liquidity tax-free, while the borrowed amount continues to grow based on the performance of the selected index(es), allowing the church’s investment to keep working while accessing needed funds. Unlike traditional loans, this structure helps churches maintain potential growth and maximize financial flexibility.

How Does an IUL Loan Benefit Your Church?

One of the key benefits of an Indexed Universal Life (IUL) policy for churches is the ability to access the policy’s cash value without triggering taxes. Churches can utilize up to 100% of the accumulated cash value through policy loans, thanks to favorable IRS provisions. This tax-free access can help fund renovations, support outreach programs, or cover unexpected expenses—all while the remaining cash value continues to grow.

See If You Qualify—it takes just 5 minutes to see your potential wealth. Click Here

Fixed IUL Loans

A fixed loan allows you to borrow against your IUL policy, with the insurance company charging a fixed interest rate on the borrowed amount. For every dollar you borrow, an equal amount of your policy’s cash value is moved into a “collateral” account. The insurance company guarantees that this collateral account will earn a specified rate of return.

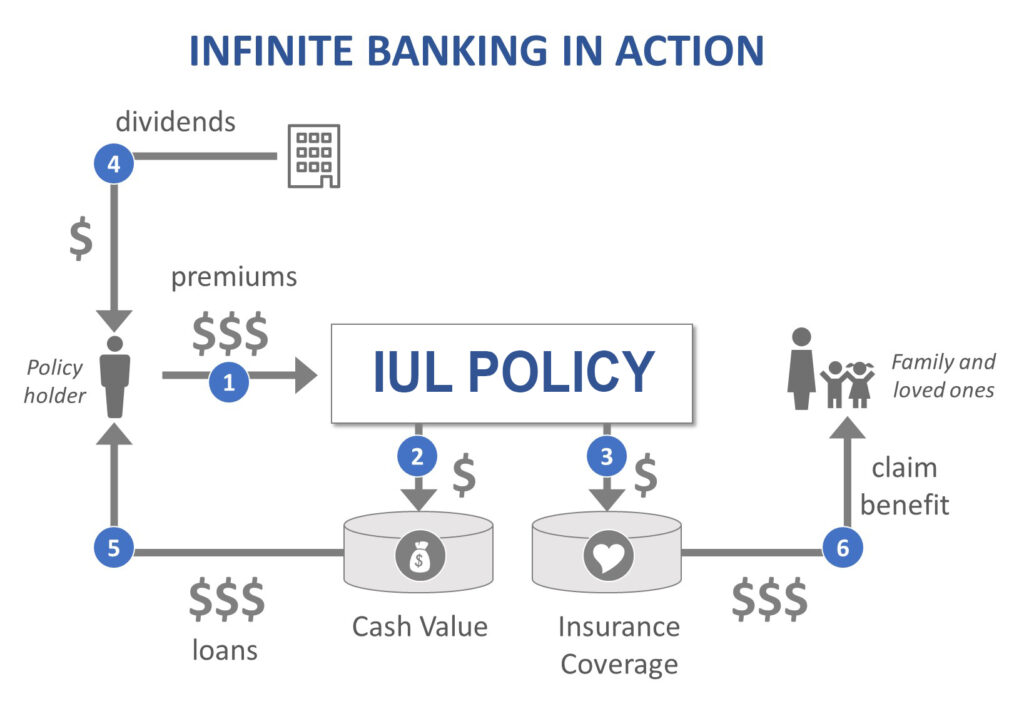

What is Infinite Banking for Churches?

Infinite banking is a financial strategy that allows churches to use the cash value in an Indexed Universal Life (IUL) policy as their own “bank.” By taking loans against the policy, churches can fund projects, manage cash flow, and support ministry needs—all while the policy continues to grow through index-based returns.

How Does Infinite Banking Work for Ministries?

The core of the infinite banking concept involves using a cash value life insurance policy, like an Indexed Universal Life (IUL), as a financial resource. With an IUL in place, a church can borrow against its cash value instead of relying on traditional lenders—essentially creating its own “mini bank.” This allows quick and easy access to funds, often just a call away, without paying interest to outside institutions.

An IUL is ideal for this strategy as it can grow cash value based on market index performance, while also offering flexibility to use dividends to enhance cash value or offset premium costs. This approach enables churches to fund projects, manage operating expenses, or seize new opportunities, all while retaining control of their financial future.

How to Start Infinite Banking for Your Church

To implement infinite banking for your church, work with an experienced life insurance broker who specializes in cash value life insurance policies. The broker will help identify an Indexed Universal Life (IUL) policy tailored to your church’s needs, considering factors like premium rates, coverage, and cash value growth potential. They will then structure the policy to maximize cash value accumulation, ensuring that it serves as a reliable financial resource for your church.

In the USA, setting up an IUL for infinite banking involves funding the policy through regular contributions and strategically building the cash value over time. Once in place, your church can use the accumulated cash value as a financing tool for various purposes, such as facility upgrades, ministry expansion, or outreach programs—without relying on traditional loans.

While there’s no strict minimum policy size for this strategy, higher premium contributions generally yield better long-term growth, allowing for more flexibility in borrowing against the cash value.

Is There a Minimum Insurance Policy Size for Infinite Banking?

While there’s no strict minimum policy size, this strategy generally works better for higher-income earners, and the premiums reflect that. Tipically a larger cash surrender value typically provides better opportunities to obtain favorable loan terms from banks.

Building Multi-Generational Wealth for Churches with IUL Policies

Churches can leverage Indexed Universal Life (IUL) policies to build multi-generational wealth and create a lasting financial legacy. By using the cash value growth potential of an IUL, a church can accumulate wealth over time, providing a reliable financial foundation for future ministry needs and expansion projects.

To be effective, securing an IUL policy with favorable rates is essential. Factors like the church’s financial stability and ability to consistently fund the premiums play a key role in maximizing benefits. Generally, it’s recommended to allocate a portion of the church’s budget—up to 10%—toward the policy to ensure steady growth and sustainability.

A deep understanding of financial strategies, such as the power of compound interest and the benefits of policy loans, is also important to effectively manage the IUL and ensure it serves as a robust tool for long-term planning. With disciplined management, an IUL can help a church support its mission today while leaving a financial legacy for generations to come.

Pros and Cons of Infinite Banking for Churches

There are a number of pros and cons associated with infinite banking.

| Pros of infinite banking | Cons of infinite banking |

| Ability to have your “own bank” and lend money from it without paying interest to the 3rd party lenders. | Costs of the insurance policy. |

| No need to go through a long lending process if you need a loan. | Not a good choice for those looking for short-term results as it takes years to accumulate a meaningful cash value to borrow against. |

| Ability to grow the cash value of a policy even faster with a participating whole life insurance policy that pays benefits. | Not a good choice for people who can not easily get access to IUL insurance policy (e.g. due to health pre-conditions). |

| Ability to select unstructured payment instead of a predefined payment plan. | You need to have a very solid understanding of the infinite banking concept since there is a chance, because it is along-term strategy, that an advisor who set it up for you will not be there after several years. |

| You continue to accumulate interest on the entire cash value even if you borrowed against it. | The interest on a policy loan must be lower than earnings. Variable loans interest range from 4%-6% with returns intrest ranging from 6%-8%. Each loan affects future earning potential. |

| Ability to benefit from an array of financial benefits e.g. lower interest rates, lack of market volatility, lack of penalty or late payment fees, etc. | Any policy loan in excess of the adjusted cost basis of the life insurance policy will be 100% taxable to the individual. |

| You continue accumulate interest on the entire cash value even if you borrowed against it. |

Is there an advantage to using a Mutual Insurance company vs a Public Insurance Company when setting up the Infinite Banking for Ministries?

Choosing a mutual insurance company over a public insurance company for setting up an Infinite Banking concept (IBC) can offer advantages such as a customer-centric approach and potentially better policy terms, like higher dividends and lower premiums. Mutual insurers, owned by policyholders, often prioritize stability and long-term satisfaction. In contrast, public insurers, accountable to shareholders, may prioritize profit motives, potentially resulting in higher costs or less favorable terms.

Top-rated insurance companies offering Indexed Universal Life (IUL) policies

A professional licensed insurance agent’s role is to assist you in selecting an appropriate provider and customizing a policy to meet your specific needs.