Best Indexed Universal Life Products

Within the fiercely contested life insurance industry, superior indexed universal life policies are likely to capture the lion’s share of sales.

Top-rated indexed universal life insurance policies

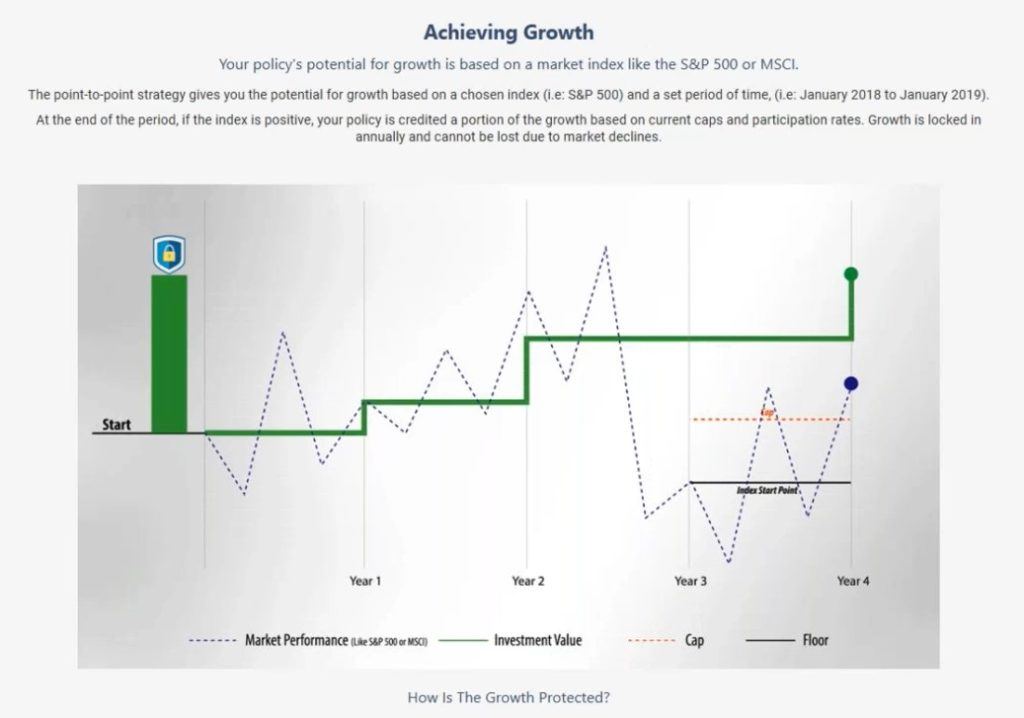

Market pressures have driven life insurance providers to develop innovative and distinctive offerings to remain competitive in this rapidly evolving sector. In response, leading indexed universal life (IUL) insurers have launched new products that offer policyholders additional advantages beyond conventional death benefits.

Top-tier IUL policies now feature supplementary perks that complement the standard death benefit and cash value growth. Familiarizing yourself with IUL products or consulting experienced IUL specialists can help address concerns about the viability of IUL as an investment option.

How to Chose the right IUL policy?

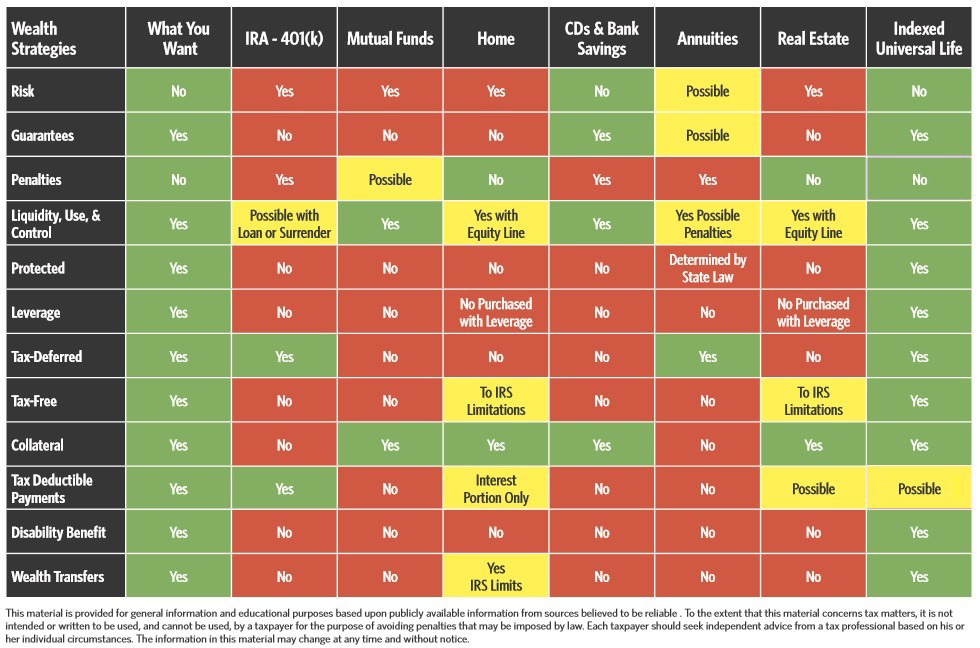

When choosing an IUL provider, it’s crucial to evaluate factors such as premium fees, index rate caps, and company ratings. Below are some examples of specialized IUL products offered by various insurers

The Bottom Line

Finding the best IUL policy can be complex due to the many moving parts involved. Consulting an IUL expert is highly recommended to ensure you get a policy that suits your needs. By carefully evaluating insurance companies and their offerings, you’ll be better equipped to select the most suitable IUL policy for your financial goals.

Top-rated insurance companies offering Indexed Universal Life (IUL) policies

A professional licensed insurance agent’s role is to assist you in selecting an appropriate provider and customizing a policy to meet your specific needs.