Why Buy Life Insurance for Your Kids?

Buying life insurance for children is just one of the many ways you can give your child a financially sound future. One of the biggest benefits is the incredible variety of policies offered by many insurance companies. Most of these can fit any family’s budget.

IUL for Children

Purchasing a life insurance policy for your child at an early age can create a financial safety net as they grow, giving them a strong financial foundation when they reach adulthood. It’s also an excellent option for providing long-term support for children with special needs.

Starting a life insurance policy for your child early can provide benefits that last a lifetime. Here’s what you should know:

✅ Affordable Premiums: Lock in low rates while they’re young.

✅ Guaranteed Coverage: Stay protected even if health deteriorate

✅ Cash Value Growth: Build a Fund for future expenses like college

✅ Double Coverage: Get double coverage when they mature.

IUL Calculator for Kids

Change age and monthly contribution to simulate different cases.

A calculator that shows how much cash value you could build up including life insurance benefits.

Your kid’s policy cash value grow each year between a cap of 8% and a floor of 0%, averaging 6.44%. This means you never lose money and lock in gains annually with protection against market downturns. Use the sliding controls to adjust age and monthly contributions to see your potential cash value at retirement. For a personalized policy, see for how much you qualify and how much you can save.

( If you need cash )

( If you die too soon )

( If you become ill )

*Tables and charts are for illustrative purposes only and do not represent any specific policy example. Please consult with a licensed agent for a specific policy for additional information. All guarantees and contractual obligations are solely based on the claims-paying ability of the issuing company. The death benefit will depend on the individual’s age and health.

The Basics

You can usually purchase a life insurance policy for your child within the first few weeks after birth and continue to do so until they are between 14 and 17 years old. Most policies offer coverage until the child turns 18 or 23.

The coverage doesn’t end there. Your child will have the option to assume ownership of the policy, allowing them to continue their life insurance at low rates. Even a child rider on your own policy can be converted into a permanent policy for them.

If you prefer to wait until they’re older, that’s fine. They’re still at a younger age compared to when most people start considering life insurance. In any case, you are securing life insurance protection for your child and helping prepare them financially for the future.

“

Get personalized quotes — Free, No-Obligation IUL Quote: Enter Info, Calculate A Deposit In 5 Min, Talk To An Agent. It Costs $0 To Run The Numbers & Calculate A Recurring Deposit. No-Obligation IUL Estimate In 5 Min.

A Quick Note On Riders Versus Standalone Policies

Some couples choose to wait until they have children to purchase life insurance for themselves. This allows them to streamline the process by adding a child life insurance rider to one of the parents’ policies.

A rider is an additional feature that provides extra coverage to a life insurance policy.

As with any insurance option, child riders have their advantages and disadvantages. Some companies specialize in child term riders, while others offer riders tailored for children with special needs.

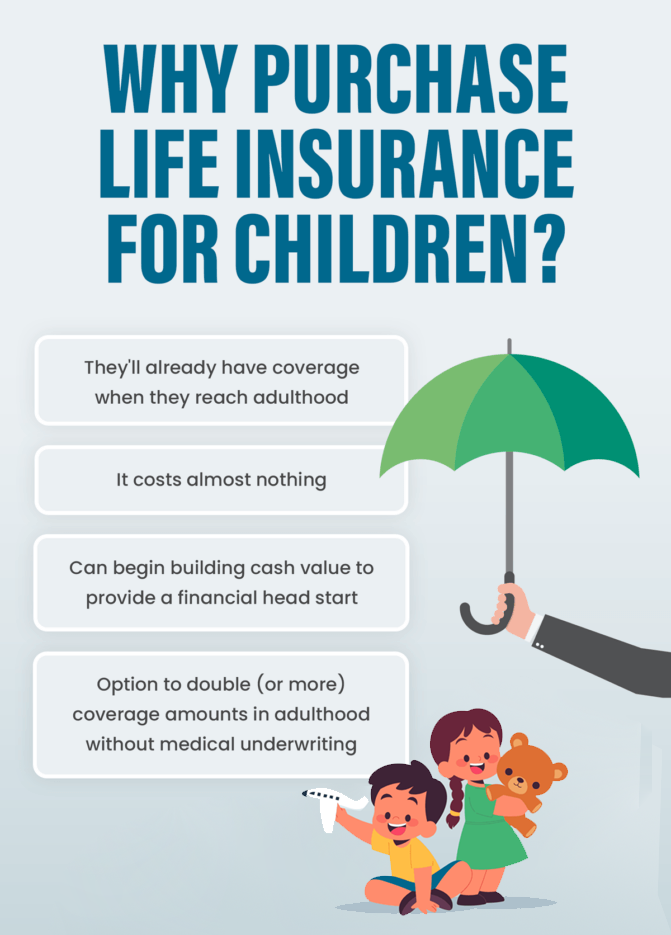

5 Reasons Why Life Insurance for Children is a Good Idea.

A life insurance policy for your children can offer many benefits and advantages as they grow up.

- Immediate Life Insurance Coverage

Your child will receive life insurance coverage right away, lasting until they reach 18 or 23 years old, depending on the insurer. When the policy nears maturity, most plans allow continued coverage regardless of health or job status.

Although most children are born healthy, unexpected health conditions like diabetes or cancer can occur at any age. Starting a policy early ensures your child maintains life insurance as they grow older.

As they mature and likely start their own family, a serious health condition developed at a young age could make life insurance unaffordable—or worse, unavailable altogether.

- Children’s Life Insurance Is Very Affordable

Many life insurance companies offer policies with coverage amounts ranging from $5,000 to $50,000 for children. These policies can cost as little as $4 per month, depending on the child’s age and the amount of coverage. Premiums are locked in for the life of the policy, so you won’t face any unexpected increases.

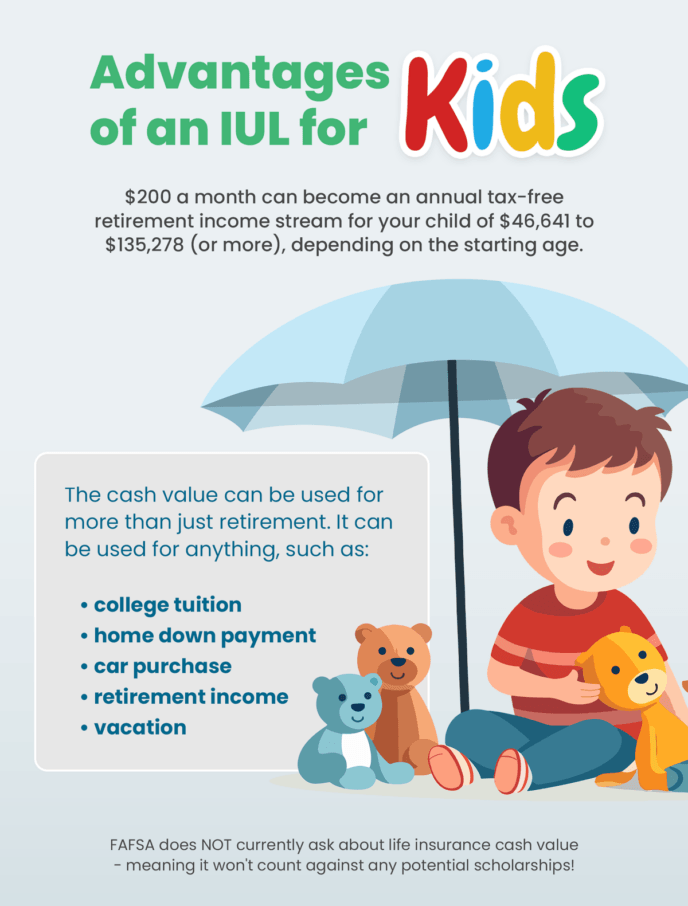

- Cash Value and Living Benefits

Permanent life insurance for children, such as whole life or universal life, can create a financial nest egg. As premiums are paid, a portion goes toward a cash value that grows over time with interest. The policy owner, whether you or your child, can borrow against this cash value for any purpose. However, borrowing will reduce the death benefit and accrue interest. Families often use these funds to cover expenses like:

- College tuition

- A down payment on a home

- Wedding costs

- Collateral for loans

- Buying a first car

If you’re sure your child will attend college, a 529 plan is a good way to save for tuition. If you’re unsure, the cash value gives your child more flexibility for their future. It is important to know that FASA do not currently ask about insurance cash value to calculate your net worth -meaning it won’t count against any potential scholarship application!

- Doubling the Coverage

When the policy matures, your child can assume ownership, and many policies allow the coverage amount to double. For instance, a $20,000 or $50,000 policy can increase to $40,000 or $100,000 automatically. This increased coverage boosts the cash value and ensures more life insurance protection as your child builds their own family.

- Coverage for Funeral Costs and Grieving Time

While no one wants to think about the loss of a child, tragedies do happen. A life insurance policy can cover funeral expenses and other outstanding bills, such as medical costs not covered by health insurance. It also provides a financial cushion, giving parents the time to focus on grieving without additional financial stress.

How to Buy Life Insurance for Children

Life insurance policies for children are now offered by many companies. Whether you’re a new parent or grandparent, you can provide a strong financial foundation for your child’s future starting today. That said, it’s important to choose the right plan for your family’s needs.

Children’s life insurance policies can differ in terms of coverage limits, underwriting requirements, and costs, which can vary greatly depending on the provider.

With so many options available, it’s best to consult an independent life insurance agent. Independent agents can work with different carriers to find a policy that is most flexible for your child’s unique needs. Since independent agents have access to numerous life insurance providers, they can compare policies for you, saving you both time and money.