IUL Insurance Family Loans

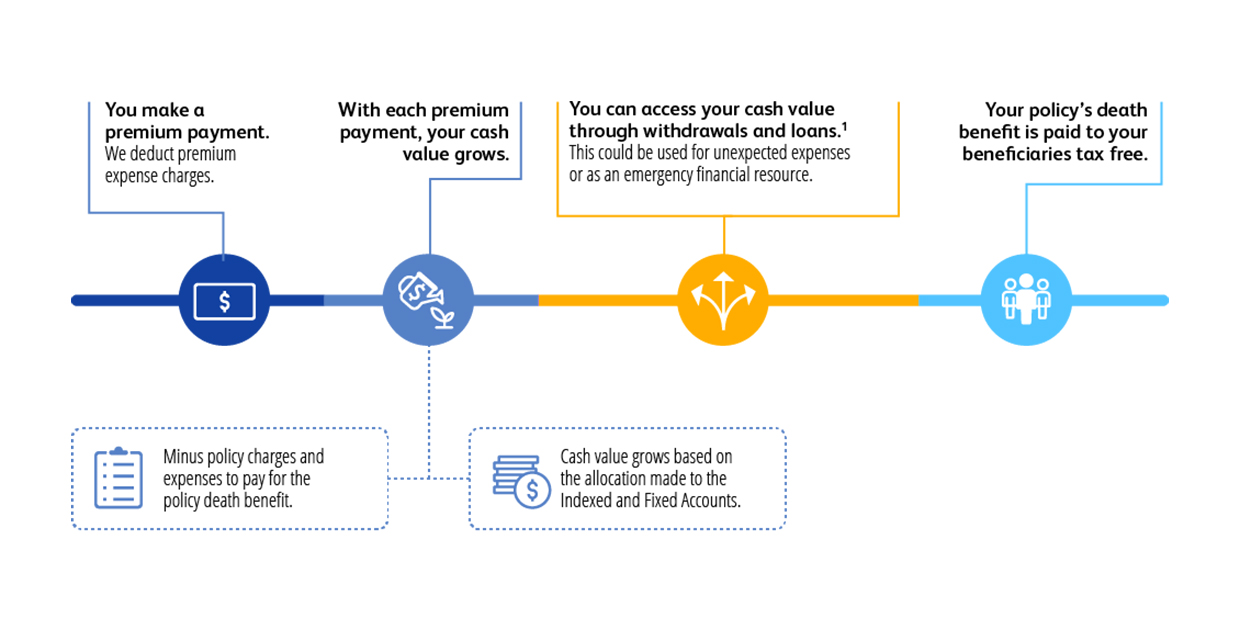

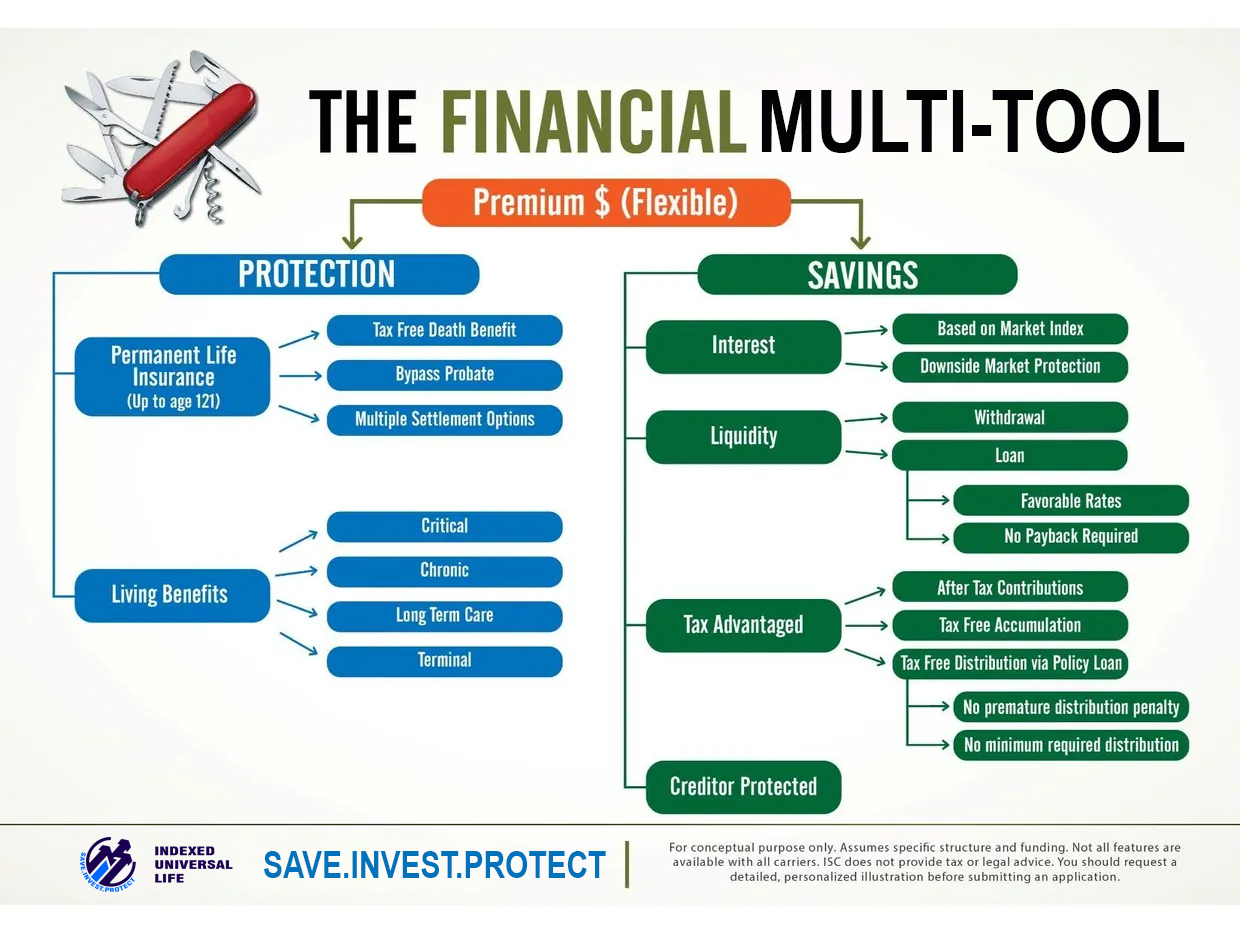

One of the major advantages of an indexed universal life insurance policy is the ability to access the cash value without incurring taxes. This benefit also allows you to utilize up to 100% of the cash value your policy has built up.

How Does an IUL Loan Impact Your Policy?

A major advantage of owning an indexed universal life (IUL) insurance policy is the ability to access your policy’s cash value without paying taxes. You can even use up to 100% of the accumulated cash value. Thanks to specific IRS provisions, you can access the cash value tax-free through a policy loan. IUL policies offer several types of loans, including:

- Variable

- Fixed

- Indexed

Fixed IUL Loans

A fixed loan allows you to borrow against your IUL policy, with the insurance company charging a fixed interest rate on the borrowed amount. For every dollar you borrow, an equal amount of your policy’s cash value is moved into a “collateral” account. The insurance company guarantees that this collateral account will earn a specified rate of return.

Indexed IUL Loans

With an indexed loan, the borrowed funds continue to follow the performance of the underlying index(es) rather than being placed in a collateral account. The collateral for your loan remains tied to the movement of the selected index(es). Typically, the interest rate charged by the insurance company on an indexed loan is higher than that of a fixed loan.

Variable IUL Loans

Variable loans are similar to indexed loans, as the borrowed funds also track the underlying index(es). However, the interest rate on a variable loan is often lower than that of an indexed loan since the insurer is not obligated to a guaranteed rate. Despite this, variable loans may still carry a higher interest rate compared to fixed loans, as the collateral is usually invested in riskier assets than cash.

“

Get personalized quotes — Free, No-Obligation IUL Quote: Enter Info, Calculate A Deposit In 5 Min, Talk To An Agent. It Costs $0 To Run The Numbers & Calculate A Recurring Deposit. No-Obligation IUL Estimate In 5 Min.

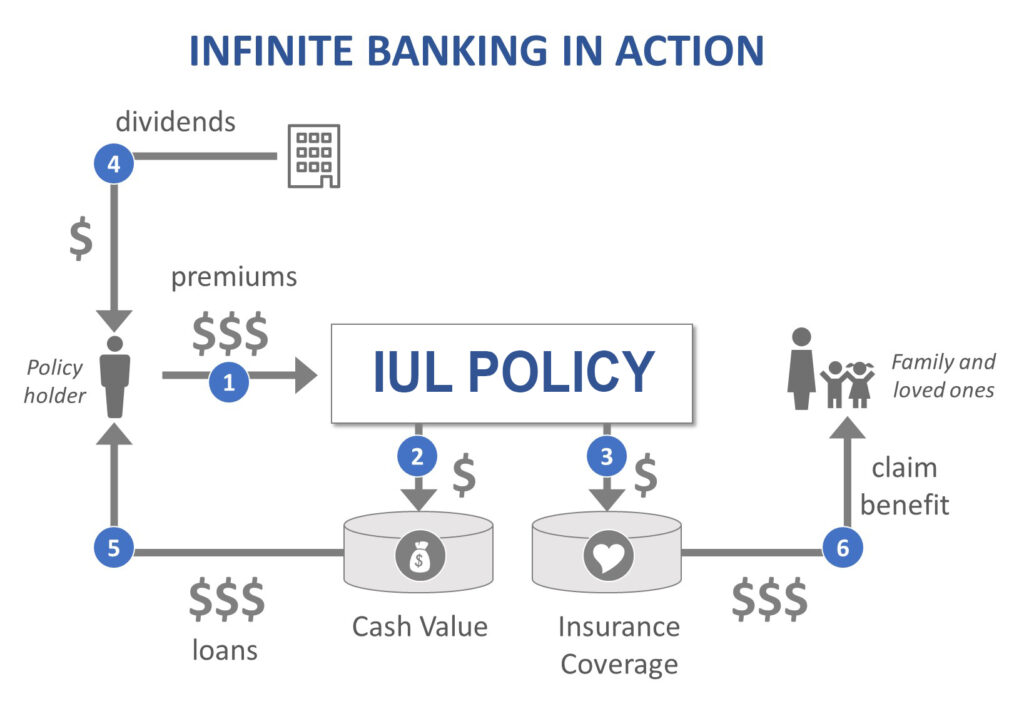

What is Infinite Banking?

Infinite banking is a personal finance strategy that leverages a cash value policy like an IUL policy as a “personal bank.” This includes taking loans against the policy and growing cash flow through the insurance’s dividends.

How Does Infinite Banking Work?

The core of the infinite banking concept is a cash value life insurance policy. Once an IUL policy is in place,for example, it is possible to lend yourself money using the cash value as collateral. That avoids paying interest to lending institutions since a policyholder has his/her own mini bank. It allows very fast access to extra funds, which are just an insurance company call away.

Typically, a indexed universa life insurance policy is used for the infinite banking concept. Participating life insurance means that a policy pays dividends, which allow contribution towards the cash value of the policy or to pay a part of insurance premiums.

A simple visual below highlights the key elements of the infinite banking concept.

How to Start Infinite Banking

To begin infinite banking, you’ll need to work with a life insurance broker who can access a variety of cash value life insurance policies and help you choose the best option for your needs (considering premium rates, coverage, and dividend potential). The broker will create a financial plan focused on infinite banking and guide you through the process of setting up the policy.

In the USA, establishing an infinite banking policy involves selecting a cash-value life insurance policy, funding it with premiums, and structuring it to maximize cash value growth. This strategy enables policyholders to use the accumulated cash value as a financing tool for various purposes, such as investments, home renovations, or supplemental retirement income.

For example, Sarah, a 35-year-old professional, sets up an infinite banking policy and contributes $10,000 annually. When she needs $50,000 for home renovations, she borrows from her policy’s cash value, avoiding traditional bank loans and maintaining control over her finances.

Is There a Minimum Insurance Policy Size for Infinite Banking?

While there’s no strict minimum policy size, this strategy generally works better for higher-income earners, and the premiums reflect that. Tipically a larger cash surrender value typically provides better opportunities to obtain favorable loan terms from banks.

Building Multi-Generational Wealth with Indexed Universal Life (IUL) Policies

Many wealthy individuals use the concept of infinite banking to grow multi-generational wealth, and the strategy can be highly effective when certain key requirements are met. One essential factor is the ability to secure a suitable indexed universal life (IUL) insurance policy at reasonable rates. If the rates are too high, for example, due to health conditions, the strategy may not be as effective.

Another critical requirement is having a stable financial foundation with a consistent income stream, as premiums for a sizable IUL policy are not insignificant. It’s crucial to ensure you can maintain premium payments to keep the policy in force. In many cases, it’s recommended to allocate up to 10% of your income toward your IUL policy.

Additionally, a solid understanding of financial concepts like compound interest, policy loans, and the growth potential of IUL policies is essential, along with the discipline to manage the policy effectively for long-term benefits.

Infinite Banking Pros and Cons

There are a number of pros and cons associated with infinite banking.

| Pros of infinite banking | Cons of infinite banking |

| Ability to have your “own bank” and lend money from it without paying interest to the 3rd party lenders. | Costs of the insurance policy. |

| No need to go through a long lending process if you need a loan. | Not a good choice for those looking for short-term results as it takes years to accumulate a meaningful cash value to borrow against. |

| Ability to grow the cash value of a policy even faster with a participating whole life insurance policy that pays benefits. | Not a good choice for people who can not easily get access to IUL insurance policy (e.g. due to health pre-conditions). |

| Ability to select unstructured payment instead of a predefined payment plan. | You need to have a very solid understanding of the infinite banking concept since there is a chance, because it is along-term strategy, that an advisor who set it up for you will not be there after several years. |

| You continue to accumulate interest on the entire cash value even if you borrowed against it. | The interest on a policy loan must be lower than earnings. Variable loans interest range from 4%-6% with returns intrest ranging from 6%-8%. Each loan affects future earning potential. |

| Ability to benefit from an array of financial benefits e.g. lower interest rates, lack of market volatility, lack of penalty or late payment fees, etc. | Any policy loan in excess of the adjusted cost basis of the life insurance policy will be 100% taxable to the individual. |

| You continue accumulate interest on the entire cash value even if you borrowed against it. |

Is there an advantage to using a Mutual Insurance company vs a Public Insurance Company when setting up the Infinite Banking?

Choosing a mutual insurance company over a public insurance company for setting up an Infinite Banking concept (IBC) can offer advantages such as a customer-centric approach and potentially better policy terms, like higher dividends and lower premiums. Mutual insurers, owned by policyholders, often prioritize stability and long-term satisfaction. In contrast, public insurers, accountable to shareholders, may prioritize profit motives, potentially resulting in higher costs or less favorable terms.

Top-rated insurance companies offering Indexed Universal Life (IUL) policies

A professional licensed insurance agent’s role is to assist you in selecting an appropriate provider and customizing a policy to meet your specific needs.