Indexed Universal Life Insurance vs. Whole Life Insurance

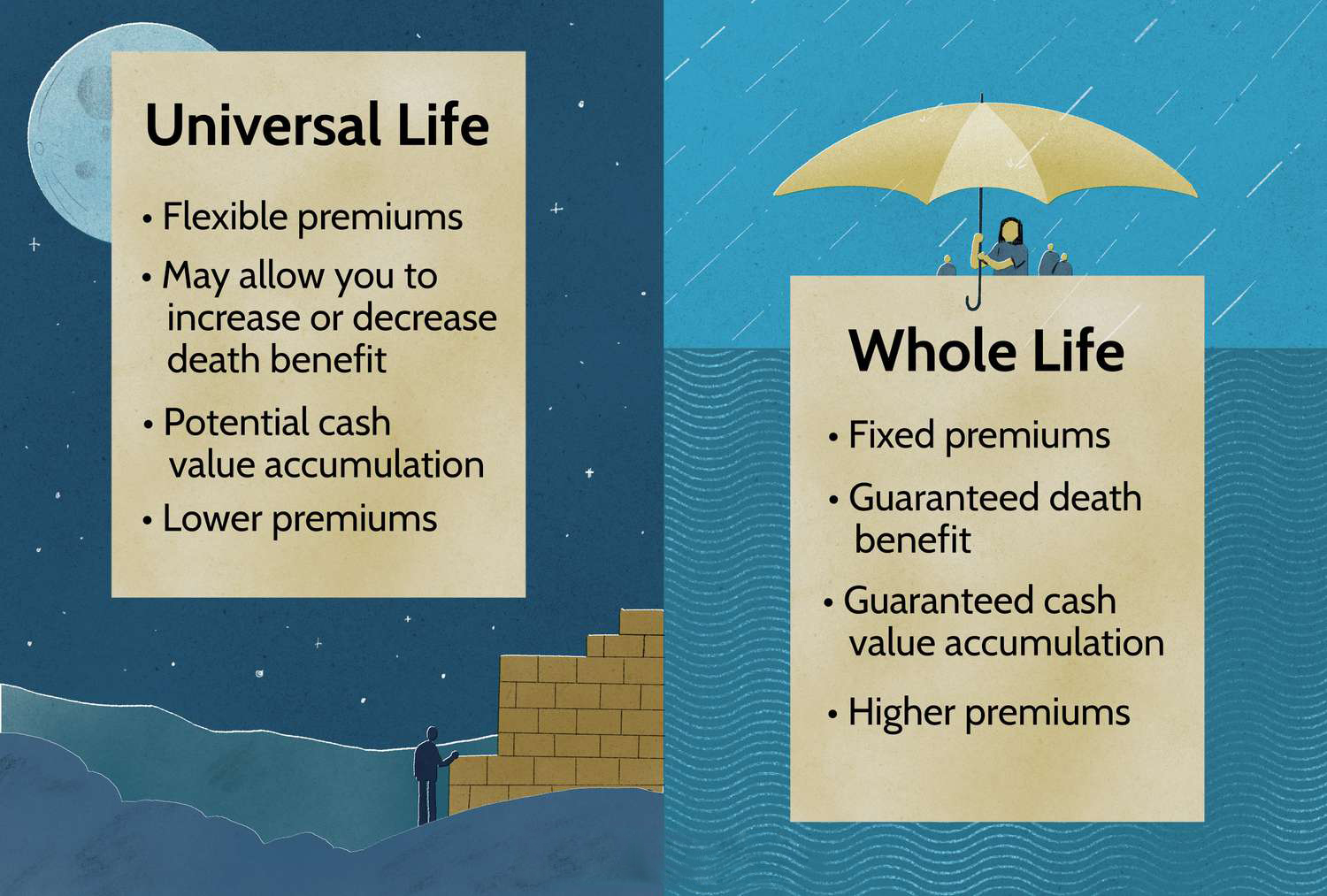

When comparing indexed universal life (IUL) insurance to whole life insurance, it’s crucial to understand their underlying mechanics and how they align with your specific financial objectives. While both IUL and whole life fall under the umbrella of permanent life insurance, they differ significantly in their structure and functionality. These distinctions, especially in areas like premium flexibility, cash value growth potential, and risk exposure, can greatly impact how each policy fits into your long-term financial strategy.

Whole Life Insurance

Whole life insurance is often regarded as the most straightforward type of permanent life insurance. It offers both a guaranteed death benefit and a cash value component. With whole life insurance, your premium payments are fixed and guaranteed not to increase, regardless of age or changes in your health.

Additionally, the death benefit amount remains constant, ensuring that your beneficiaries receive a predetermined, tax-free payout if something happens to you. The cash value in a whole life policy grows at a consistent interest rate set by the insurance company. This growth is tax-deferred, meaning you won’t owe taxes on gains as long as they remain within the policy, allowing the funds to compound over time. However, the interest rate is typically low, often not keeping pace with inflation.

As with other permanent life insurance types, policyholders can access their cash value through loans or withdrawals. However, any outstanding loan balance, including interest, will reduce the final death benefit payout to your beneficiaries.

Indexed Universal Life Insurance (IUL)

Indexed universal life insurance (IUL) is another form of permanent life insurance, similar to whole life, offering a death benefit and cash value growth. However, the key distinction between the two is how interest is calculated on the cash value. In an IUL, returns are tied to a market index, like the S&P 500 or the Dow Jones Industrial Average, which can potentially offer higher returns than a whole life policy with a fixed interest rate.

Despite being linked to market performance, the cash value in an IUL is protected from losses during market downturns. If the index performs negatively, the cash value is typically credited with a 0% return, meaning no loss is incurred, though no growth occurs either.

The growth of an IUL’s cash value is also tax-deferred, and funds can be accessed through withdrawals or tax-free policy loans, offering flexibility for purposes like supplementing retirement income or funding a child’s education.

Which Type of Policy is Right for You?

When deciding between whole life and IUL, it’s important to consult a financial professional who specializes in IUL and life insurance. They can help you determine which option best suits your financial goals and answer any specific questions you may have.