Should you say “No” to IUL ?

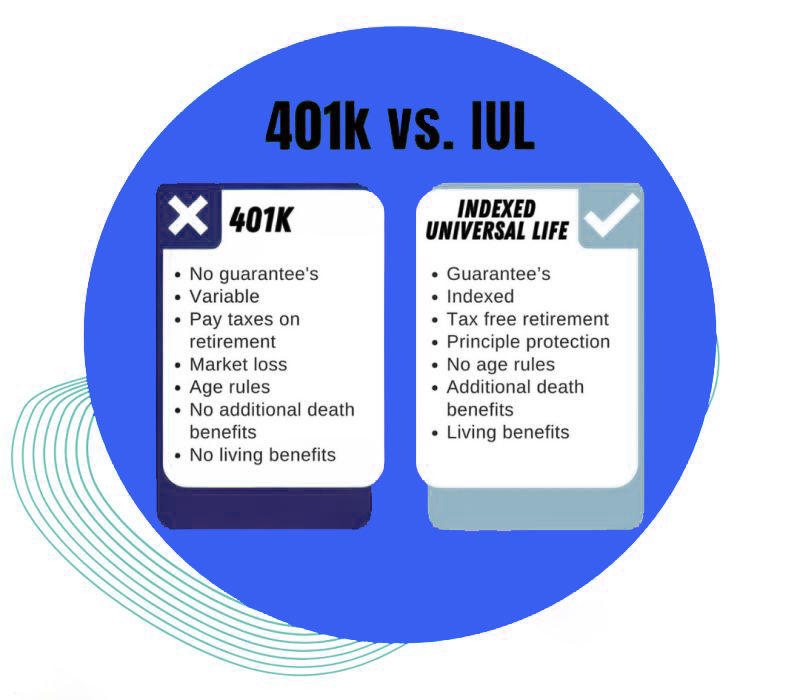

While indexed universal life insurance offers numerous benefits, it may not be the best fit for everyone. Due to the complexity of these policies, it’s essential to understand how an IUL might suit your needs—or if other options could be a better choice.

Key Considerations Before Purchasing an IUL Policy

Before deciding to purchase an Indexed Universal Life (IUL) policy, it’s important to consider several key factors and understand the trade-offs involved. We encourage you to carefully weigh these considerations to determine if an IUL is the right fit for your unique needs.

For instance, the way returns are credited to your cash value in an IUL differs from the simpler calculations used in other types of permanent insurance, like whole life or traditional universal life policies. One potential drawback is the “cap” on returns, which can limit your gains in years when the index performs well. On the other hand, when the index underperforms, your cash value is protected from negative returns, offering a valuable trade-off to safeguard your principal.

The Value of Consulting an IUL Expert

Consulting with an experienced financial expert who specializes in indexed universal life insurance can be incredibly helpful. They can provide valuable insights into how these policies function and help you determine whether an IUL aligns with your financial goals and needs.

Understanding the Costs Associated with IUL Policies

Like other life insurance policies, Indexed Universal Life (IUL) policies come with expenses. Common fees include:

- Premium expense charge

- Cost of insurance

- Administrative fees

- Surrender charges

These costs vary depending on the policy, the insurance provider, and factors like your age, gender, and coverage amount. Additional riders added to customize the policy for your needs can also affect the cost.

It’s important to consider these expenses against the potential costs of not taking action, as well as fees associated with alternative investments. In some cases, caps and premium charges may be minimal compared to the benefits.

Consulting a knowledgeable financial expert with experience in IUL policies can help you better understand how these costs and features may affect your financial plan.