Indexed life sales break records in fourth quarter, Wink reports

Life insurance sales closed 2023 with a very strong fourth quarter, according to Wink’s Sales & Market Report.

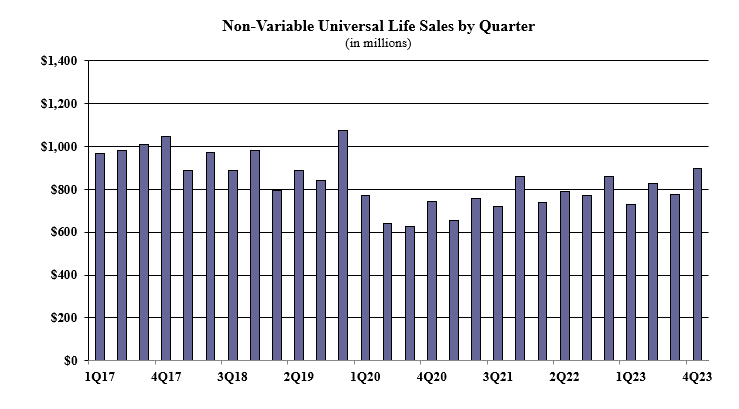

Non-variable universal life sales for the fourth quarter totaled $894.5 million, up more than 15.5% compared to the previous quarter and up 4.1% compared to the same period last year. Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the fourth quarter included National Life Group retaining the No. 1 overall sales ranking for non-variable universal life sales, with a market share of 14.6%. Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined for the eleventh consecutive quarter.

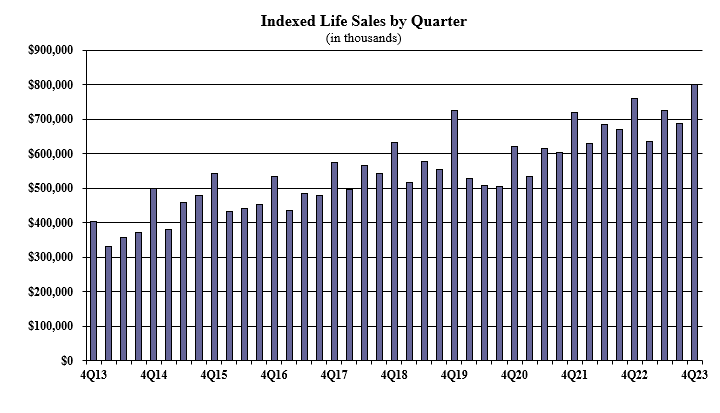

Indexed life sales for the fourth quarter were $799.1 million, up more than 16.2% compared with the previous quarter, and up 5% compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life. This was a record-setting quarter for indexed life sales, topping the prior 4th quarter 2022 record by 5%.

This was also a record-setting year for indexed life sales, topping the prior 2022 record by 3.6%.

“I am projecting that 2024 will be another record year for indexed life,” said Sheryl J. Moore, CEO of both Moore Market Intelligence and Wink, Inc. “It is the fastest-growing segment of the life insurance market.”

Items of interest in the indexed life market included National Life Group retaining their No. 1 ranking in indexed life sales, with a 16.3% market share, Transamerica, Pacific Life Companies, Nationwide, and Lincoln National Life rounded out the top five, respectively.

Transamerica Life’s Transamerica Financial Foundation IUL was the No. 1 selling indexed life insurance product, for all channels combined for the eleventh consecutive quarter. The top primary pricing objective for sales this quarter was cash accumulation, capturing 76% of sales. The average indexed life target premium for the quarter was $11,974, an increase of nearly 3% from the prior quarter.

Fixed UL sales for the fourth quarter were $95.6 million, up 10.2% compared to the previous quarter and down 10.6% compared to the same period last year.

Noteworthy highlights for fixed universal life included the top primary pricing objective of No Lapse Guarantee capturing 50.1% of sales. The average UL target premium for the quarter was $5,736, an increase of more than 4% from the prior quarter.

“While UL sales were up for the quarter, we are forecasting that they will be down in 2024,” Moore said.

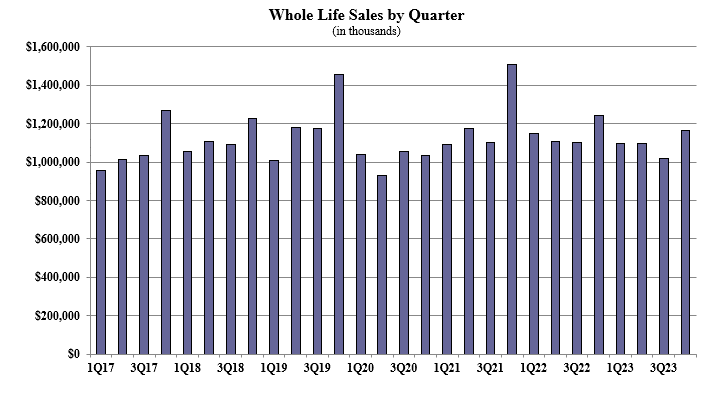

Whole life fourth quarter sales were $1.1 billion, up 14.3% compared with the previous quarter, and down more than 6.3% compared to the same period last year.

Items of interest in the whole life market included the top primary pricing objective of Final Expense capturing 54.5% of sales. The average premium per whole life policy for the quarter was $4,051, an increase of more than 5% from the prior quarter.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on structured universal life, variable universal life and additional annuity product lines will be available starting with the first quarter 2024, Moore said.